Basic Plan

$24/Month

- 10000 message credits/month

- 300 Messages/Day

- Send DM To All Twitter Followers

- Unlimited Twitter Account

- Message Sent In Random Interval

- Premium Support

You can schedule twitter auto direct message that will be sent to all your twitter followers within some time frame. Send Dm to all twitter followers.

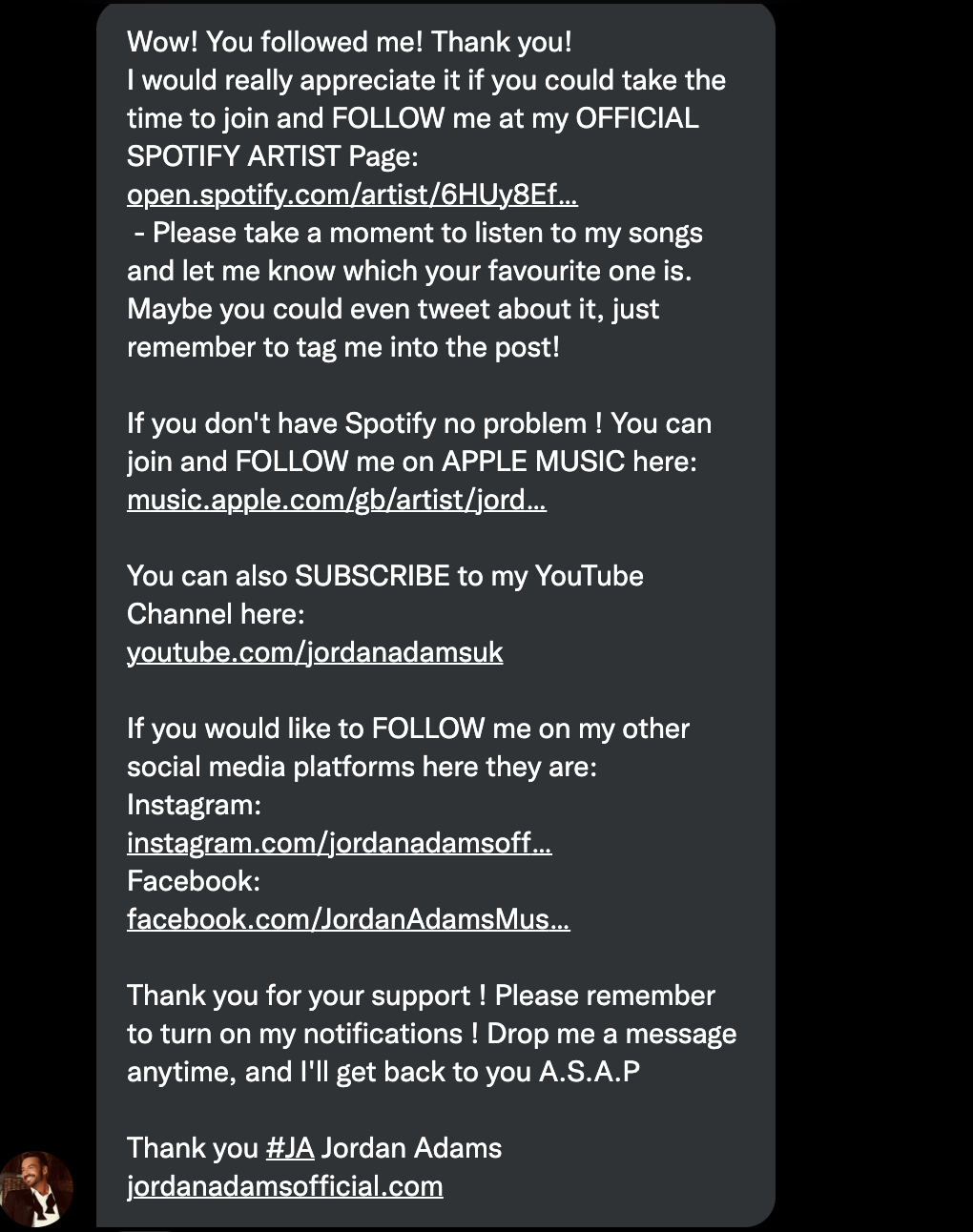

Create Awareness ( Promote your FB groups, Linkedin group, Slack community etc ) Check out example on the Image.

Promotions your product or target existing customers. Check out example on the Image. Viral Your Business ( Send DM Campaigns to your millions of followers on Twitter and get viral )

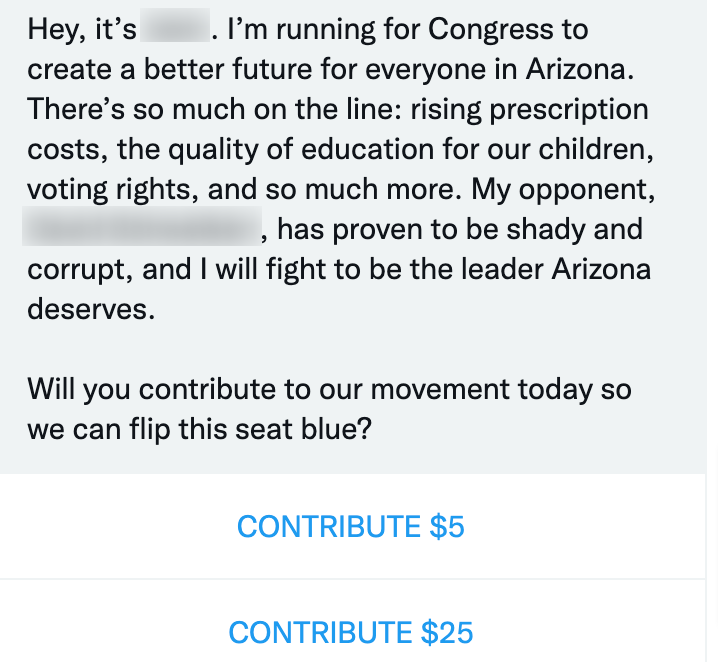

Run a donation campaign or crowdfunding using Twitter mass DM. Check out example on the Image.

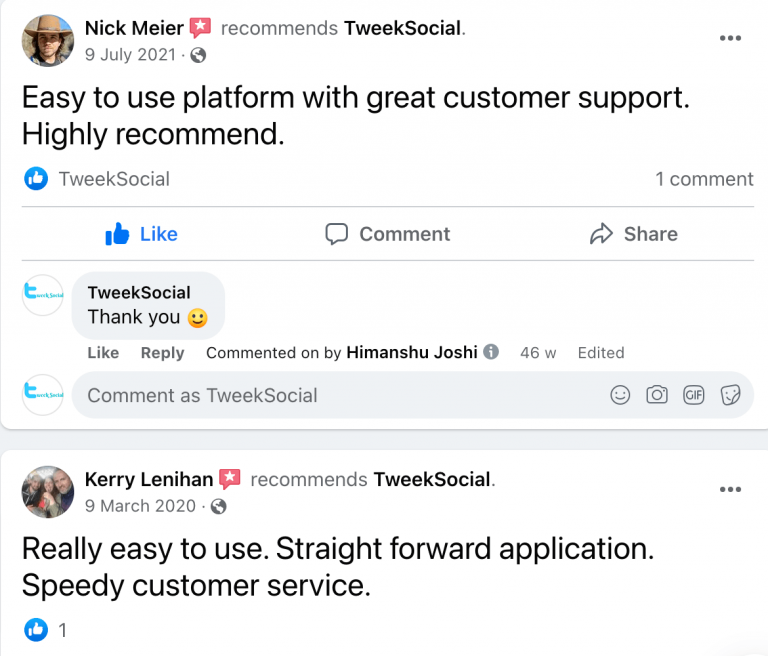

Our Clients Say

Contact Us – info@tweeksocial.com,

United Kingdom – Kemp House 160 City Road,

London, EC1V 2NX

GO TOP